|

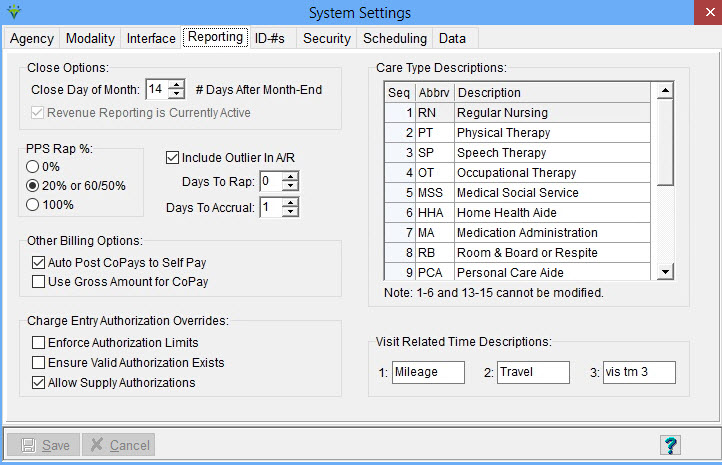

Reporting Tab The System Settings Reporting tab stores billing and accounts receivable reporting settings, authorization settings, Care Types and optional charge visit related time descriptions. Click on FILE>FILE MAINTENANCE>SYSTEM SETTINGS, Reporting tab. Visit-Based Revenue: Close Day of Month: enter the maximum number of days into the next month that the Close option in the Revenue Reporting menu will be enabled. Choose a value from 1-14 (a value between 7-14 days is suggested). NonVisit Based Revenue: Close Day of Month: enter day of the month to be used for a hard close (billing audits, transfers and payments will not be able to use post dates outside of the closing date range). Default is -1 which places no restrictions on posting dates.

For example, enter 0 for the

closing date to be the last day of the month (will not be able to enter

a post date prior to current month unless running retroactive run for

late/corrected charges) or enter a number (ex. 5 = closing date

of the 5th). 0% - Post 0$ for RAPs. Will post $ for the period only at the time of posting the Final Claim. 20% or 60/50% - For PDGM, post 20% at the RAP and 80% for the Final Claim. For PPS claims prior to 1/1/2020, post the intial 60% (for SOCs) or 50% (for Recerts) when the RAP is run and the remainder at the Final Billing Audit. 100% when RAP is run - This option posts entire EEP (Expected Episodic Payment) to AR when RAP billing audit is posted. Include Outlier in A/R Amount - Check if the system should post Outlier adjustments to the A/R when posting Final billing audits. Days to Rap: Enter the number of days prior to the Period 2 Start Date a RAP can be generated. For example, to bill a Period 2 RAP 29 days prior to the period start date, enter -29. To bill a Period 2 RAP 1 day prior to the period start date, enter -1. A value of zero will utilize 2020 edits and hold the RAP from billing until a billable visit, 485 (not a Verbal Order) and locked OASIS are present; not recommended as this can cause late RAP penalties.For PDGM prior to 2021, this field was used to enter the # of days into the billing period before auto-generation of the RAP with no billable visit was allowed. (enter a value between -29 to 30 days). Days to Accrual: For PDGM billing periods starting on or after 1/1/2022, this controls how many days to hold the SOC Period 1 from accruing revenue. This optional delay period allows for patient insurance corrections to be made to prevent revenue from accruing on the PPS Revenue Report for non-PDGM patients (enter a value between -1 to 28 days). Default is 1 day. Other

Billing Options: Auto Post CoPays to SelfPay: Check if you wish the dollar amount entered in the patient's insurance co-pay field to automatically be deducted from the visit(s) charge amount when the bill audit (click for example of an autocopay audit) is posted. For this feature to function properly, the Self Pay insurance must be present and active for the patient. Use

Gross Amount for CoPay: Check if you wish the gross amount of the

charge, not the pro-rated amount, to post to the Self Pay insurance

when Auto Post option is selected. NOTE: if Gross option is not selected, and the charge is prorated with the insurance rate NOT set to write the balance to Allowance, then the pro-rated amount will be added to the CoPay amount that is auto-transferred to SelfPay. Allow

Verified Visit Selection: if selected, there will be an option in the

Billing Audit allowing the user to select "Verified Visits Only".

Rarely used -- added for non-Scheduling clients who wish to mark visits

as verified before billing.

Ensure Authorization Limits: If checked off, when entering charges the system checks to make sure the charge does not exceed the authorized quantity and will stop the user from entering the charge if it exceeds the authorization limit. Enforce Valid Authorization Exists: Used in charge entry, if selected the system checks for the existence of an authorization with a date range including the charge date and a valid modality for all charges. Rarely used. Allow Supply Authorizations: Check to allow entering authorizations for supplies. For this option, if the user enters a specific charge code for that authorization then any charges that have the same HCPCS as the entered charge will be evaluated to attach to the authorization. When checked, edits are enforced on the Billing Pre-Audit and Billing Audit if the supply authorization is missing and insurance is set to require auths. Care Type Descriptions: 1-6 and 13-15 are hard-coded and cannot be modified. Care Types are used when assigning authorized disciplines to employees and are linked to charges by way of modality. Charges are linked to a modality and each modality is linked to a care type. For a charge to be counted as a Medicare visit, it must be linked to a Care Type of 1 -6. Visit Related Time Descriptions: User-defined fields that can be used to track time spent on items like charting or conferences. Visit related time is entered during charge entry in Charge>Enter/Maintain. These items do NOT post to payroll but can be exported to an Excel file as part of the charge export under File > Import/Export.

|